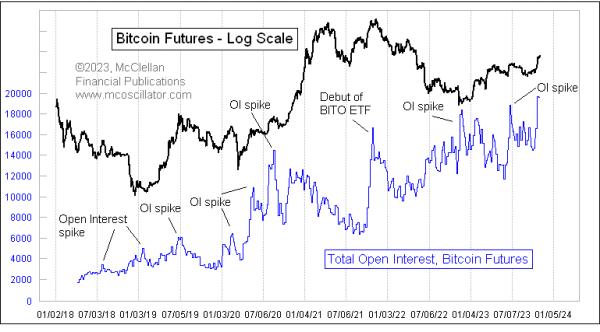

There is growing speculation that the Securities and Exchanged Commission (SEC) of the U.S. federal government is close to approving one or more spot Bitcoin ETFs to begin trading. That speculation has driven up Bitcoin prices to the highest level in more than a year. It has also driven up total open interest in Bitcoin futures.

Bitcoin has been around as a cryptocurrency since January 2009, but Bitcoin futures contracts have only been trading since December 2017. And they did not make an appearance in the CFTC’s Commitment of Traders (COT) Report until April 2018. Adoption of trading Bitcoin futures has been gradual, and it is still a long way from matching the size of total open interest we see in the eMini S&P 500 contract, for example, which recently had over 2 million contracts of open interest.

The fascinating aspect of total open interest in Bitcoin is that, every once in a while, it sees a spike in a relatively short amount of time. When that happens, it nearly always marks a turning point for Bitcoin prices. It can be a top or a bottom.

This is all relevant now because Bitcoin prices have been rushing higher recently, as traders speculate on that SEC approval happening soon. They had the same rush on speculation about the debut of BITO, the Bitcoin Futures ETF, and that spike marked the all-time high for Bitcoin prices. Other spikes have marked turning points of lesser importance, but it is a reliable indication.

A spot Bitcoin ETF is a big deal because an ETF trading futures is inherently inefficient as an “investment”, because of contango in the contract pricing, though it can be useful for trading. Here are futures prices as of Nov. 3, 2023:

Nov23 34890 Dec23 35305 Jan24 35495 Feb24 35750 Mar24 35930 Apr24 35980

An ETF which owns futures contracts will concentrate its ownership in the nearest month contracts because they are more liquid. As those contracts are nearing expiration, the ETF will be forced to “roll” to contracts further into the future. Since those contracts are priced higher than the near-month contract, the ETF loses out with every roll. An investor who sits in a Bitcoin futures ETF for very long is losing value every month versus spot Bitcoins. So if a spot Bitcoin ETF could ever get approved, that would open up a new way for average investors to own Bitcoin without having to worry about “wallets”, or brokers who have not been around for very long.

Speculators are rushing in ahead of that anticipated surge in demand, just as they rushed in ahead of BITO’s approval only to see it top. The same dynamic occurred with gold when it was finally authorized public ownership in 1975. Late 1974 saw a big run up in worldwide gold prices as speculators in other countries tried to front-run the anticipated surge in demand once U.S. investors were finally going to be allowed to own gold. The initial demand never lived up to those expectations, and gold prices dropped from $186.80/oz in December 1974 all the way down to $110.10 by August 1976.

The lesson here is that those who are chasing into Bitcoin now on speculation about the impending ETF approval are likely going to end up like those 1974 gold speculators, and like the earlier Bitcoin speculators who topped Bitcoin prices as they rushed in ahead of the debut of BITO.